|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Help to Buy Mortgage Lenders: Understanding Key InformationThe Help to Buy scheme has been a game-changer for many prospective homeowners. It provides an opportunity for individuals to step onto the property ladder with reduced deposit requirements. This article explores the benefits and use cases of Help to Buy mortgage lenders. Understanding Help to Buy MortgagesHelp to Buy mortgages are designed to make buying a home more accessible. These loans are typically available to first-time buyers and existing homeowners looking to move up the property ladder. Benefits of Help to Buy Mortgages

Who Can Benefit from Help to Buy?The Help to Buy scheme is primarily aimed at first-time buyers, but it also supports existing homeowners who wish to move. Buyers must meet certain criteria, such as purchasing a new build home that is within the regional price cap. Eligible Properties

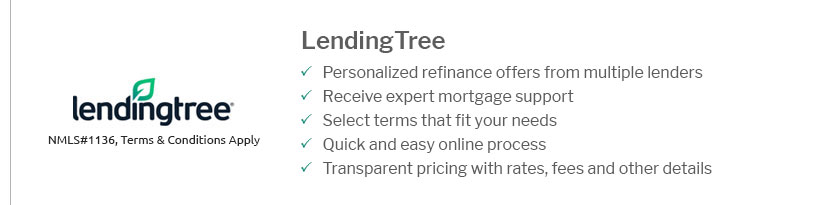

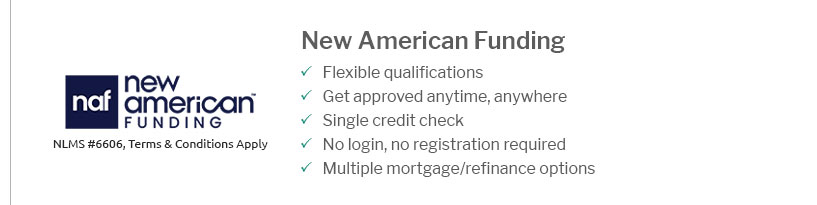

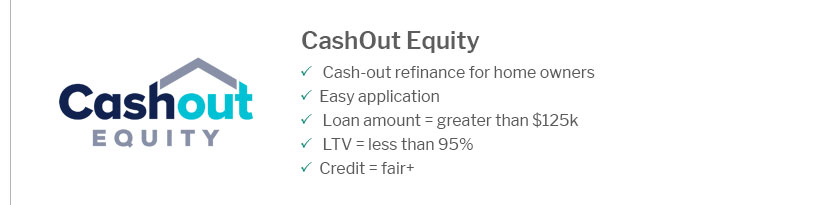

Understanding the nuances of the Help to Buy scheme can help potential buyers make informed decisions when seeking the right mortgage option. For example, those interested in the latest rates might explore options available through wisconsin mortgage rates today. Choosing the Right LenderChoosing the right lender is crucial for securing the best possible terms. Help to Buy mortgage lenders often offer competitive rates and favorable terms, but it's important to compare offers and understand the fine print. Factors to Consider

For those in Rhode Island, exploring mortgage companies in ri can provide insights into local lenders that might offer Help to Buy options. Frequently Asked QuestionsWhat is the maximum amount I can borrow with a Help to Buy mortgage?The amount you can borrow depends on the property's price and your financial situation. The government provides an equity loan of up to 20% (40% in London) of the property's value. Can I use Help to Buy for a second home?No, the Help to Buy scheme is only available for your main residence and cannot be used for second homes or buy-to-let investments. How do I repay the Help to Buy equity loan?The equity loan is interest-free for the first five years. After that, you will start paying interest. The loan must be repaid either when you sell your home or at the end of the mortgage term. https://www.consumerfinance.gov/consumer-tools/mortgages/

Whether you're thinking of buying a home, already have a home loan, or are having trouble paying your mortgage, we have resources to help you every step of ... https://singlefamily.fanniemae.com/originating-underwriting/mortgage-products

... assistance for very low-income purchase (VLIP) first-time homebuyers. For deliveries beginning March 1, 2025, at least one borrower on the loan must be a ... https://www.va.gov/housing-assistance/home-loans/loan-types/purchase-loan/

Lenders offer competitive interest rates on VA-backed purchase loans. This can help you buy, build, or improve a homeespecially if you don't ...

|

|---|